|

Government is NOT a business! Although there is some utility of business principles in managing government, administration of government is not the same as running a business!

If a business fails, goes bankrupt, people are hurt...employees without work, business contracts broken, invoices unpaid. But the extent of damage is limited, usually proportional to the size of the failed corporation. If the Federal government fails the extent of harm to our society would be ...uugh! More importantly, public debt is not the same as commercial or personal debt.. From statements made, it is apparent that Trump and many of his minions do not understand this fact. Trump has stated that if he were to become President that he might renegotiate US foreign debt. This would be a "shot heard around the world", a cataclysm for world financial markets leading to a global financial crisis. No longer would foreign investors trust that American debt is backed by "the full faith and credit"* of the United States government. *(An unconditional commitment to pay interest and principal on debt issued or guaranteed by the US Treasury or other government entity.) So U.S. public debt needs to be understood related to global finances, international socioeconomics and geopolitics. Public vs. Private Debt Incurring debt, private or public, can be beneficial and/or detrimental. Taking on debt is a financial tool. Tools such as a hammer can be used to build but it can also demolish. How does this apply to our national debt? Creditors-Domestic vs. Foreign:

Public vs. Private economy and debt: External debt is owed to outsiders; internal debt is owed to those who, at least in part, are obligated to pay the debt.

Employment, Economy and Debt Debt and credit are the gas driving the engine of the economy. When driving uphill, one must keep the foot to the petal increasing fuel usage. Even as the upward slope begins to diminish, one’s foot must continue to press the accelerator or momentum will be lost perhaps resulting in going backwards down hill. But once comfortably over the peak, the driver can safely let up on the fuel pedal reducing the need for gas. As it is in driving up and down hill to reach your destination, so it is with the ups and downs of the economy. The absolute national debt and national debt relative to the GDP will rise, going “uphill”, in response to government spending in a recessionary economy since the growth in the GDP is slowed. Public investment in the US economy leading to job creation in stagnant economies has lead to recoveries resulting in significant decrease in the debt to GDP ratio. There are many historical and contemporaneous examples. Mitt Romney who rails against federal deficit spending and the national debt has made his fortune by using leveraged debt. His business experience is primarily in vulture capitalism-the business of putting large sums of money in his hands and his wealthy investors while letting employees and taxpayers suffer the consequences in many “investments”. A Bain Capital prospectus claims an annualized return of 88% for over a decade. This unbelievable rate of return was significantly “funded” indirectly from the public coffers and workers pocket books. For instances, the Pension Benefit Guaranty Corporation, a government created corporation insuring private-sector employee defined benefits, has provided tens of millions of dollars to employees of a company which Bain Capital bankrupted while still making tens of millions of dollars. Debt is good for Romney, bad for many others who were never involved in his speculations. As a venture capitalist, Romney helped fund Staples, a corporation whose CEO made $15.2 million in 2011 while the lowest paid employees including computer repair technicians and copy center specialists starting at $8/hr to a maximum of approximately $13/hr, nearly a 1000:1 ratio in pay scale. Gross disparities in income with the middle and lower socioeconomic classes suffering loses in earnings reduces demand resulting in reduced business and tax revenues. Public-sector jobs

An unprecedented drag on the recovery By Josh Bivens | April 5, 2012 Since the recovery from the Great Recession officially began in June 2009, private-sector jobs are up by 2.8 million, but public-sector jobs (the combined employment in federal, state, and local governments) are down by 584,000. The figure below compares trends in public-sector employment in the last four recoveries. The current recovery is the only one that has seen public-sector losses over its first 31 months. If public-sector employment had grown since June 2009 by the average amount it grew in the three previous recoveries (2.8 percent) instead of shrinking by 2.5 percent, there would be 1.2 million more public-sector jobs in the U.S. economy today. In addition, these extra public-sector jobs would have helped preserve about 500,000 private-sector jobs. There is reason to be optimistic, though, as public-sector losses have moderated recently. If the sector begins to actually add jobs in the coming months, the economy could benefit significantly in the future. NATIONAL DEBT INCREASED BY WEALTHY Quotes from Adam Smith

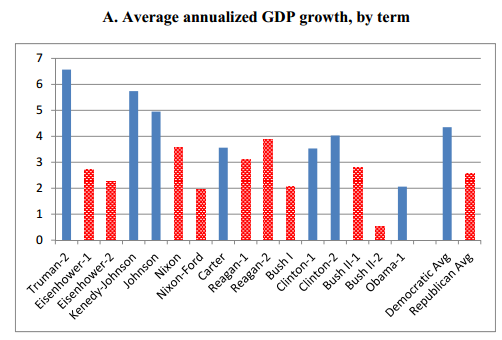

REVENUE AND SPENDING CUTS Who Pays No Federal Income Tax: · 50 percent are in this category because their incomes are so low that they are less than the sum of the standard deduction and personal and dependent exemptions for which the household qualifies. As TPC Senior Fellow Roberton Williams has noted, “the basic structure of the income tax simply exempts subsistence levels of income from tax.”** Some 62 percent of the households who will owe no federal income tax in 2011 have incomes under $20,000. · Another 22 percent do not owe federal income tax because they are elderly people who benefit from tax provisions to aid senior citizens, such as the exemption of Social Security benefits from income tax for beneficiaries who have incomes below $25,000 for single filers and $32,000 for joint filers and the higher standard deduction for the elderly. · Another 15 percent (of the households who don’t owe federal income tax) don’t owe the tax because they are low-income working families with children who qualify for the child tax credit, the child and dependent care tax credit, and/or the earned income tax credit, and the credit(s) eliminate their income tax liability. REPUBLICAN VS. DEMOCRATIC PRESIDENTS Who wins the economy ball game? Growth in GDP... 1948-1952 (Harry S. Truman, Democrat), +4.82% 1953-1960 (Dwight D. Eisenhower, Republican), +3% 1961-1964 (John F. Kennedy / Lyndon B. Johnson, Democrat), +4.65% 1965-1968 (Lyndon B. Johnson, Democrat), +5.05% 1969-1972 (Richard Nixon, Republican), +3% 1973-1976 (Richard Nixon / Gerald Ford, Republican), +2.6% 1977-1980 (Jimmy Carter, Democrat), +3.25% 1981-1988 (Ronald Reagan, Republican), 3.4% 1989-1992 (George H. W. Bush, Republican), 2.17% 1993-2000 (Bill Clinton, Democrat), 3.88% 2001-2008 (George W. Bush, Republican), +2.09%

0 Comments

Leave a Reply. |

Proudly powered by Weebly